US Foods Launches MOXē E-Commerce App for Foodservice Distribution

US Foods Holding Corp. has begun the national roll-out of MOXē (Making Operator Xperiences Easy), the foodservice distribution industry’s most advanced and the only all-in-one e-commerce application that can be used across desktop, tablet and mobile devices anywhere, anytime. MOXē is a personalized one-stop shop where operators can find the right products from a selection of more than 400,000 items, manage orders and track deliveries in one application.

US Foods Holding Corp. has begun the national roll-out of MOXē (Making Operator Xperiences Easy), the foodservice distribution industry’s most advanced and the only all-in-one e-commerce application that can be used across desktop, tablet and mobile devices anywhere, anytime. MOXē is a personalized one-stop shop where operators can find the right products from a selection of more than 400,000 items, manage orders and track deliveries in one application.

“US Foods has been a pioneer and leader in food service technology solutions for more than a decade,” said Gene Carbonara, vice president of e-commerce and digital for US Foods. “With MOXē, we’ve taken a major step forward in the evolution of the customer e-commerce experience from a performance and ease-of-use perspective. Our new technology offering will continue to set US Foods apart from the competition for many years to come as we deliver on our promise to help our customers Make It.”

Designed from the ground up, leveraging years of research and insights from operators and US Foods support teams, MOXē was developed with a strategic focus on providing enhanced speed, confidence and control for the operator in one intuitive solution for US Foods Holding Corp. has begun the national roll-out of MOXē (Making Operator Xperiences Easy), the foodservice distribution industry’s most advanced and the only all-in-one e-commerce application . Key attributes of MOXē also draw on familiar consumer e-commerce user functionalities to guide the operator from product discovery to delivery.

- Speed: MOXē’s interface and customized all-in-one application provide the fastest e-commerce experience in the food service distribution industry. The user experience makes it easy for both operators and US Foods sellers to quickly accomplish everyday tasks and focus on deeper strategic support to continue driving the operator’s success.

- Confidence: Enhanced product features help operators make informed product decisions, using real-time inventory, ratings and reviews, nutritional information, labor savings capabilities and preparation suggestions all in one place.

- Control: The application’s integrated functions enable operators to stay organized with shopping lists, easily manage orders and track their delivery in real-time on any device.

MOXē will begin rolling out to independent operators across the country and will continue expansion to additional customers in 2023.

For updates in the food and beverage industry, subscribe to Gourmet News.

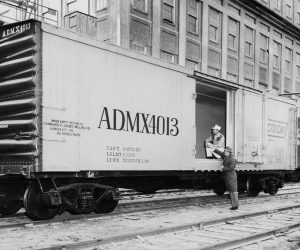

Agricultural Supply Chain Company ADM Marks 120 Years

ADM, the Archer-Daniels-Midland Company, has marked 120 years in business as an agricultural supply chain leader.

ADM was incorporated on Sept. 30, 1902, in Minneapolis as a regional linseed oil business. Today, ADM with 41,000 employees serving customers in nearly 200 countries – is a global agricultural supply chain manager and processor, a premier human and animal nutrition company, a trailblazer in groundbreaking solutions to support healthier living, a cutting-edge innovator in replacing petroleum-based products, and a leader in sustainability.

“Over the past 120 years, our company has evolved from a regional startup into an irreplaceable leader providing needed nutrition to billions around the globe. We’ve transformed at many moments along the way, but unlocking the power of nature to enrich lives has always been at the heart of everything we do,” said Juan Luciano, chairman and CEO.

“Every day, our 41,000 colleagues demonstrate our purpose and our values, not only by feeding the world, but by building a stronger, better future, whether through innovations in sustainability, or our commitment to the communities where we work and live. I’m proud of the work they’ve done and the journey we’ve taken together, and I’m excited about our bright future.”

To celebrate the milestone, ADM conducted a Fight Hunger Challenge to bring employees together around the world to raise money for hunger relief. As a result, ADM Cares has donated 1.2 million meals in partnership with the World Food Program, Feeding America and Food Banks Canada.

ADM’s founders were an unlikely but fortuitous match. George Archer was a quiet man and a deliberate planner, widely respected for his comprehensive knowledge of the linseed oil industry. John Daniels was outgoing and brash, extremely popular in trade circles and a leader in industry associations. Their distinct personalities made for a formidable combination and, in many ways, created the DNA of the company we are today.

To learn more about ADM’s history, visit https://www.adm.com/en-us/about-adm/our-company/history/.

For news of interest to the food and beverage industries, subscribe to Gourmet News.

SpartanNash Names Crane as VP, Finance/Food Distribution

SpartanNash has named Greg Crane as vice president, Finance/Food Distribution. Crane will serve as finance business partner to Bennett Morgan, senior vice president and chief merchandising officer, and support the Food Distribution leadership team.

Crane’s role, effective June 6, includes leadership over budgeting, forecasting, monthly results analysis and risk and opportunity assessment activities for the Food Distribution business. Additionally, he will provide thought leadership and financial guidance on both broad strategic initiatives and day-to-day opportunities to improve efficiency and reduce company operating expenses.

Crane’s role, effective June 6, includes leadership over budgeting, forecasting, monthly results analysis and risk and opportunity assessment activities for the Food Distribution business. Additionally, he will provide thought leadership and financial guidance on both broad strategic initiatives and day-to-day opportunities to improve efficiency and reduce company operating expenses.

Crane, a registered CPA, brings more than 15 years of financial and operational experience with skills in financial management, strategic and financial planning, mergers and acquisitions, capital markets and performance optimization. Most recently, he served as the CFO for GHSP, Inc. Before that, he spent nearly six years at Wolverine World Wide in a variety of financial and leadership positions.

For more updates on the specialty food industry, subscribe to Gourmet News.