Historic Hotels Set Up Fantastical Gingerbread House Displays

Gingerbread houses are a German creation, perhaps inspired by or popularized by the fairy tale “Hansel and Gretel” in the early 1800s. Immigrants to the United States brought ginger and gingerbread traditions with them.

As an art form for pastry chefs and a sweet treat for children, gingerbread decorating is a tradition to unite the generations, and gingerbread displays are the centerpieces of elegant lobbies at the world’s most prestigious hotels. Year after year, legendary hotels, resorts, and inns create magnificent gingerbread displays to delight and inspire guests.

Historic Hotels of America, the official program of the National Trust for Historic Preservation for recognizing authentic historic hotels, offers travelers memorable ways to experience holiday traditions, many dating back decades, if not centuries.

The 2023 Top 25 Historic Hotels of America Most Magnificent Gingerbread Displays are the result of thousands of hours of culinary, pastry, confectionary, engineering, and carpentry teams working for weeks, and even months, to design, create, mix, bake, build, and, of course, decorate. Collectively, the ingredients of these displays add up to thousands of pounds of sugar, eggs, and flour; hundreds of pounds of spices; more than 10,000 individual candies; and hundreds of gallons of molasses and honey. Feast your eyes and enjoy!

The Broadmoor (1918) Colorado Springs, Colo.

The Broadmoor’s magnificent gingerbread display has been a grand holiday tradition since 1964. This year, the gingerbread display is a replica of a Lightning Bug Canopy Boat, in honor of an upcoming 2024 resort amenity.

The Broadmoor’s magnificent gingerbread display has been a grand holiday tradition since 1964. This year, the gingerbread display is a replica of a Lightning Bug Canopy Boat, in honor of an upcoming 2024 resort amenity.

For years, guests of The Broadmoor have enjoyed paddle boats on the resort’s very own Cheyenne Lake. However, when the hotel opened in 1918, there were canopy boats that cruised silently across the placid waters. In the summer of 2024, two beautiful new electric canopy boats will once again grace the lake, harkening back to the early days of the resort.

The confectionary replica was crafted with over 958 pounds of powdered sugar, 475 pounds of flour, 1,801 eggs, plus a canopy adorned with candies and sweet treats, including candy canes, gumdrops, macarons, meringues, peppermints, and jellybeans. The gingerbread display is on the Mezzanine level of the main historic building.

Previous gingerbread displays have included the resort’s intricate Pauline Chapel and The Broadmoor Special – a 1918 Pierce Arrow Touring Car that was converted by Broadmoor Founder, Spencer Penrose, into an iconic race car. In 2020, Chef Adam Thomas and his team of chocolatiers and bakers installed a giant train car known as the “Cog Railway.” Since 2013, the historic resort’s gingerbread creations have been life-size, and played a vital role in the resort’s holiday celebrations, going up at Thanksgiving, and remaining on display until the new year.

Last year’s creation drew inspiration from The Broadmoor’s founder, Spencer Penrose, and his 1937 Flat Head V-8 Cadillac Touring Car. The gingerbread designs are always over-the-top and are loved by families who visit the resort during the holiday season. A National Historic Landmark, The Broadmoor is a Charter Member of Historic Hotels of America since 1989.

Watch: Time-lapse video showing creation of the Lightning Bug Canopy Boat Gingerbread Display

The Omni Homestead Resort (1766) Hot Springs, Va.

The Omni Homestead Resort, a National Historic Landmarka, is known for its extensive holiday decorations and displays, including spectacular gingerbread assemblies. Each year, The Omni Homestead Resort’s executive pastry chef and team imagines and bakes a new dreamy gingerbread creation to display in the historic resort’s Great Hall.

For 2023, the gingerbread display is a post office, which includes a mailbox to send letters to Santa. This year’s creation is 9 feet tall and 12 feet long, weighing hundreds of pounds, and was created using 150 pounds of sugar, 60 pounds of candy, and over 250 pounds of gingerbread. The team—which included six culinary professionals, as well as several carpenters—took two weeks to build the display.

The holiday gingerbread display is a time-honored tradition at The Omni Homestead Resort, where each executive pastry chef determines the design. In previous years, the display has been a fireplace, a gingerbread village representing the resort, and a recreation of the hotel’s iconic central tower. Guests are invited to decorate their own gingerbread houses, and can enjoy many other holiday activities, including s’mores by the fire and bedtime stories with Santa’s elves.

The Red Lion Inn (1773) Stockbridge, Mass.

The 250th Anniversary Holiday Candy House at the Red Lion Inn is an outlier on the list for containing no baked gingerbread, but it certainly packs on the candy, and for that it earns its place among other legendary displays. Measuring 62 inches long, 21.5 inches wide, and 31 inches tall, the candy house weighs roughly 120 pounds.

Transportation of the display from the staging area to the main dining room required six men, the removal of a door, an industrial cart, an elevator, and two guides to direct the placement. But long before then, over 40 team members at The Red Lion Inn spent 40 hours planning, designing, and shopping for ingredients.

Construction and decoration required 128 hours, and it involved the creative minds and time of over 40 members of the Inn’s team to put on the finishing touches. The candy house has been a tradition at the Inn, founded in 1773, for many years, and this particular candy house is a grand tribute to the historic inn’s 250th holiday season this year. The Red Lion Inn is a Charter Member of Historic Hotels of America since 1989 and, famously, is featured in Norman Rockwell’s iconic work Home For Christmas (1967).

Ingredient Spotlight:

- 4.75 feet of Ribbon Candy

- 5 pounds of Victorian Glass Candies

- 4 pounds of Licorice Bites

- 3.5 pounds of Jujyfruits

- 2.8 pounds of Mike & Ikes

- 2.65 pounds of Sprinkles

- 1.5 pounds of Spree Candies

- 1,840 Necco Wafers

- 628 Pez Candies

- 597 Berry Gems

- 300 Charms Squares

- 287 Fruit Drops

- 245 Pillow Mints

- 226 Gumdrops

- 202 Peppermint Candies

- 168 Winter Mint Candies

- 124 Vanilla Barrels

- 112 Peppermint Sticks

- 105 Butterscotch Drops

- 80 Licorice Whips

- 2 Chocolate Lions

Omni Bedford Springs Resort (1806) Bedford, Pa.

When guests walk into the lobby of the Omni Bedford Springs Resort this December, they will be greeted by the sweet smell of gingerbread, along with the resort’s concierge, whose desk is located within the gingerbread display. Magnificent gingerbread displays are an annual tradition at the historic Omni Bedford Springs Resort, but this year’s display is larger and more impressive than ever before.

Chef Harshal Naik, who has been with the Omni Bedford Springs Resort for several years and competed on The Food Network’s Holiday Baking Championship in 2022, is a wiz at gingerbread, and tries to outdo each year’s display the following season. This year, Chef Harshal collaborated on the project with 45 students from the Building Construction program at Bedford County Technical Center, under the instruction of Steve Sellers, who used Chef Harshal’s plans to design and construct the framework of the village from wood. Meanwhile, Chef Harshal and his team of five pastry chefs worked for almost three weeks preparing the gingerbread bricks (6,800 bricks made from 240 pounds of gingerbread dough), and another week assembling the gingerbread village.

The display is 34 feet long, 8 feet deep, and 12 feet tall. On top of the gingerbread—and putting the students’ engineering skills to the test—are 60 pounds of royal icing, 40 pounds of marshmallows, 360 chocolate bars, 100 peppermint chocolate patties, and 1,400 peppermint hard candies. A National Historic Landmark, Omni Bedford Springs Resort was founded in 1806 and inducted into Historic Hotels of America in 2007.

French Lick Springs Hotel (1845) French Lick, Ind.

Made from sugar (a whopping 673 pounds of regular and powdered sugar) and spice (eight pounds of ginger, cloves, cinnamon, and nutmeg) and everything nice, the gingerbread house at French Lick Springs Hotel is a holiday tradition that guests eagerly anticipate every holiday season. The historic Indiana resort hotel’s bakery chefs Brittany Fisher, Princess McCallister, and Chantilly Tuell (plus several “elves”) concoct a fresh gingerbread house design every holiday season.

This year, the gingerbread neighborhood has expanded to include multiple side-by-side houses. The first magnificent gingerbread display is Santa’s Workshop, with sugar-cookie gears on the chimney, candy wrenches and tools on the shingles, and Christmas presents cascading down two chutes on the side of the house. The second house is Mrs. Claus’s Bakery, with larger-than-life holiday treats, including half-pound chocolate chip cookies. Creating these 8-foot-tall houses starts nine months in advance – the first batches of gingerbread were baked in February, and the bakery staff chips away at this enormous project bit by bit throughout the year.

Visitors smell the gingerbread display before they see it, as the warm aroma of gingerbread fills the halls of the hotel, inviting guests to see this culinary masterpiece. The house is on display now through the first week of January. French Lick Springs Hotel, listed in the National Register of Historic Places, dates back to 1845, and was inducted into Historic Hotels of America in 2000.

Grand Hotel Golf Resort & Spa (1847) Point Clear, Ala.

Located on 550 acres on Mobile Bay, the Grand Hotel Golf Resort & Spa has been known as The Queen of Southern Resorts for over 175 years. In record-time this year—just 23 days—Chef Kimberly Lyons and her team built the Grand Hotel Golf Resort & Spa, Autograph Collection’s annual gingerbread display in the historic Alabama resort’s lobby.

An annual Grand Tradition since 2006, the display offers guests a sweet tour of the Historic Main Building (listed in the National Register of Historic Places) and the surrounding grounds of the Grand Hotel Golf Resort & Spa through this larger-than-life gingerbread village. The gingerbread display is a replica of the resort’s Historic Main Building that was built in the 1940s and Bucky’s Lounge, Bayside Grill, the activity lawn, and other features of the resort, which are made out of delectable icing, candy, and spice cake.

Chef Kimberly and her team used 150 pounds of icing, 75 pounds of flour, 25 pounds of sugar, 14 pounds of shredded coconut, 1,000 gumdrops, and 30 different types of candies. The display measures 18 feet long, 7 feet wide, and 3 feet at its tallest point. Making the tradition a game each year, Chef Kimberly and her team hide nuggets of fun throughout the display to see if guests can find them.

Some of the hidden references this year include:

- A Butterfly Tree, an homage to the Monarch Butterflies that migrate through the resort every October

- Snowman Chefs, each representing a member of the resort’s culinary team

- Michael Herzog, the resort’s General Manager

- Grand Hotel Golf Resort & Spa’s friendly ghost, who loved the hotel so much that they never left

- 3 Beach Bikes, a great way to get around the resort

- A Wedding Cake, a nod to many joyful occasions held at the resort over the past year

- Nitro, Chef Kimberly’s pet dog

Mohonk Mountain House (1869) New Paltz, N.Y.

The annual gingerbread display at Mohonk Mountain House consists of a whimsical and delicious collection of displays selected from the Annual Hudson Valley Gingerbread Competition, hosted by the resort and in its 9th year in 2023. Displayed pieces are chosen by a panel of judges, and up to 15 of the entries are displayed throughout the Mohonk main house during December.

Out of 40 submissions the competition accepts each year, the judges choose first, second and third place for both adult and junior categories. Creativity is key, and entries depict everything from robots, fairy houses, and dinosaurs, to classic cottages.

Each entry, combined with a base, must not be larger than 24 inches high, 24 inches wide, and 24 inches long. The bakers who submit these works of edible art begin working months in advance.

The historic resort also hosts in-person voting on competition day for a “people’s choice award,” selected by resort guests and visitors. Visitors who want to attend the competition day but not stay at the resort can purchase a Gingerbread Pass for $15, fully donated to The Hudson Valley Food Bank, allowing access to view the winners throughout the main house. In addition to the competition day, guests can purchase the Gingerbread Pass for select dates until the end of the year to view the gingerbread display, self-guided Christmas Tree tour, enjoy the festive decor, take advantage of sales in the gift shop and spa retail store, and benefit from special rates for ice skating at the outdoor pavilion.

Mohonk Mountain House was designated a National Historic Landmark in December 1986, and was inducted into Historic Hotels of America in 1991.

St. James Hotel MN (1875) Red Wing, Minn.

For the past three years, the St. James Hotel’s Pastry Chef, Amy Zerwas, has introduced a sweet bit of holiday cheer to the hotel’s lobby in the form of a magnificent gingerbread display. Initially introduced as a pandemic-era pick-me-up for the staff, designing and building the historic hotel’s holiday gingerbread display has emerged as a new tradition for the team, and one that guests can enjoy, too. This year’s magnificent gingerbread display is a replica of the historic Red Wing Depot, a train station designed by Chicago, Milwaukee, St. Paul and Pacific Railroad architect J.U. Nettenstrom.

The Depot opened to the public in 1905, and while it was later replaced by a modern station, it was restored in 1991, and now serves as a local art gallery. The sweeter, smaller version of this historic depot can be found Nov. 24 through Jan. 1 in an alcove in the main lobby of the St. James Hotel and is complemented by the hotel’s annual display of model trains.

Chef Zerwas oversaw the planning, mixing, construction, and decorating of the display, which required 22 pounds of flour, 12.5 pounds of molasses, 5.5 pounds of shortening, 4.25 pounds of sugar, and nearly 3 pounds of spices. The Red Wing Depot replica measures 3 feet long, 1.5 feet wide, and 2 feet at its tallest point. The St. James Hotel is listed in the National Register of Historic Places and was inducted into Historic Hotels of America in 1994.

1886 Crescent Hotel & Spa (1886) Eureka Springs, Ark.

1886 Crescent Hotel & Spa invites guests to participate in a special interactive holiday gingerbread display this year. Located in the hotel lobby, the central gingerbread house was baked, built, and decorated by the hotel’s baker, and serves as the focal point, with many small gingerbread houses added over the course of the December holidays by guests.

Although the display does not portray a specific real place, the historic hotel’s staff created a gingerbread display that embodies the spirit of togetherness and creativity that defines the holiday season at the 1886 Crescent Hotel & Spa, creating a gingerbread village that reflects the guests who stayed at the hotel in December. The village grows throughout the holiday season.

In the making of these creations, the hotel estimates they will use over 100 pounds of gingerbread dough, 30 pounds of royal icing, and 50 pounds of assorted candies. As a resort activity, all guests and visitors are invited to decorate their own small gingerbread houses and add their house to the village. The interactive gingerbread display was introduced in 2021 and began with the hotel staff’s desire to create a unique and memorable experience for guests during the holiday season.

Nestled in the Ozarks, where local healing waters once attracted health-seeking travelers, 1886 Crescent Hotel & Spa is listed in the National Register of Historic Places and was inducted into Historic Hotels of America in 2000.

Wentworth Mansion (1886) Charleston, S.C.

The exquisite gingerbread house on display in the lobby of Wentworth Mansion, is a detailed replica of the building itself. Crafted with care by the hotel’s passionate pastry team, led by Chef Ashley Cardona, this extraordinary creation captures not just the architectural splendor of the historic hotel, but also the festive spirit of the holiday season.

The pastry team of four dedicated artisans invested over 100 hours to create this masterpiece. From meticulously designing to-scale templates, to handcrafting and assembling each component, their expertise and passion for culinary artistry was evident in every step of the process. The team adorned the mansion with individually piped royal icing and hand-cut gingerbread bricks, showcasing exceptional skill and commitment to bringing this enchanting display to life. The finished display measures 18 inches by 24 inches, and weighs just under 50 pounds, constructed entirely from edible materials.

The base is composed of traditional gingerbread, hand-painted with brick-red hues to mirror the mansion’s façade. Each “glass” window was meticulously cut from gelatin leaves and tailored to match precise dimensions.

Notably, the cupola, a signature architectural feature, was fashioned from pastillage, a decorative sugar paste traditionally used for intricate sugar sculptures. Details like stairs, landscaping, and the roof were sculpted from Rice Krispies Treats and enveloped in fondant, lending texture and authenticity.

Using a palette of edible food colors, Chef Ashley added depth and detail, especially to areas like the roof and brick courtyard. To achieve an authentic touch, she applied edible copper luster dust, imparting a genuine metallic appearance to the roof. This year marks the inaugural debut of a Wentworth Mansion gingerbread display, and the team hopes to make it a cherished tradition for guests and staff alike for years to come.

Wentworth Mansion is listed in the National Register of Historic Places and was inducted into Historic Hotels of America in 2003.

Hotel Colorado (1893) Glenwood Springs, Colo.

The life-sized, interactive holiday gingerbread display at Hotel Colorado wraps around the hotel’s Legends Coffee & Gift Shop, and invites guests to enjoy a seriously sweet shopping experience. The gingerbread house is 16 ft. high, 12 ft. long, and 14 ft. wide, and was built using 311 pounds of gingerbread and 8 gallons of frosting. Four people worked together for over a week to bake, build, and decorate the sweet and spiced house.

The gingerbread display at Hotel Colorado is a time-honored tradition and has been a major part of the hotel’s holiday displays for the past 15 years. Although it has moved locations a few times, it is now a tradition to build the gingerbread display around the exterior of the Legends Coffee & Gift Shop.

Naturally, with over 300 pounds of gingerbread displayed, the halls of this historic hotel are filled with the aroma of molasses and ginger. The gingerbread house is on display as part of the hotel’s large-scale holiday décor. The hotel is open to anyone to visit, take photos, and enjoy the beautiful display.

Located in the great Rocky Mountains, Hotel Colorado is listed in the National Register of Historic Places and was inducted into Historic Hotels of America in 2007.

The Jefferson Hotel (1895) Richmond, Va.

“What if Santa Claus enjoyed cookies, candy, and sweet confections not just one night of the year, but year-round?” This bit of lore-questioning by the staff at The Jefferson Hotel led to the design and construction of a magnificent gingerbread display in this historic hotel’s Palm Court lobby this December.

Santa’s Sweet Shop is a colorful, magical scene depicting the jolly old elf’s sweet shop, complete with a conveyor belt of gingerbread cookies, jars filled with candy, and an area for making and decorating gingerbread cookies. According to the storytellers at the hotel, Santa built his Sweet Shop to show the industrious elves how much he appreciates them. Behind the scenes, however, a team of 10 people—including current hotel staff and former staff who returned to celebrate the hotel’s holiday season—worked closely for almost three weeks to complete the project, led by Executive Pastry Chef Sara Ayyash.

The Jefferson Hotel’s Santa’s Sweet Shop is 10 feet tall, 15 feet long, and 5 feet deep. It required 260 pounds of flour, 86 pounds of shortening, 72 pounds of brown sugar, 10 gallons of molasses, 12 pounds of ginger, and 6 pounds of cinnamon—and that’s just to make the gingerbread! Adding up the frame, gingerbread, royal icing, and candy, the magnificent gingerbread display weighs over 3,000 pounds.

The gingerbread display is a time-honored tradition at The Jefferson Hotel, listed in the National Register of Historic Places and a Charter Member of Historic Hotels of America since 1989.

Candy Spotlight:

- 100 pounds of Marshmallows

- 375 ft. of Nerds Rope

- 20 pounds of Jellybeans

- 20 pounds of Chocolate Sixlet Candies

- 15 pounds of Gumballs

- 10 pounds of Red Hot Cinnamon Drops

- 10 pounds of Christmas Candy Corn

- 10 pounds of Crushed Peppermint

- 15 pounds of Gummy Candies

- 5 pounds of Chocolate Mint Drops

- 5 pounds of Gumdrops

Moana Surfrider, A Westin Resort & Spa (1901) Honolulu

As the first hotel in Waikiki, the Moana Surfrider, A Westin Resort & Spa has enchanted guests each holiday season with its joyful ambience and festivities for 122 years. This holiday season, the historic hotel presents an enchanting experience: a magnificent life-sized gingerbread house titled “Christmas in Hawai’i.” This year’s display shows off iconic island motifs like hula skirts, canoes, and palm trees. Adorned with vibrant candy decor, the hotel’s gingerbread house is made up of thousands of gingerbread bricks, gallons of egg whites, and hundreds of pounds of candy and icing.

Construction of the display required three culinary experts to build, a team led by Pastry Chef Carmen Montejo. They logged 504 hours to bake this larger-than-life display, which was unveiled on Dec. 12 and is now open to the public in the hotel’s main lobby.

The decked-out gingerbread display welcomes guests and visitors to pose for photos and selfies of the awe-inspiring gingerbread house, as well as take in the scents and sounds of the holiday season. The impressive gingerbread display is near the dazzling two-story Christmas tree that greets visitors in the historic lobby.

Along with the decor, the oceanfront resort offers a signature Keiki (child) Christmas Tea on Fridays, Saturdays and Sundays in December for guests under 12. The keiki tea set includes a gingerbread cookie, milkshake, Santa hat and the Moana teddy bear.

Known as the “First Lady of Waikiki,” the Moana Surfrider, A Westin Resort & Spa, is listed in the National Register of Historic Places and is a Charter Member of Historic Hotels of America since 1989.

The Fairmont Hotel San Francisco (1907) San Francisco

For over a century, The Fairmont Hotel San Francisco has enchanted guests with its joyful holiday festivities and seasonal ambiance in The City by the Bay. One of the hotel’s most spectacular annual traditions is its stunning gingerbread house. At the end of November each year, the hotel lobby transforms into one of the world’s most beloved holiday destinations, where cherished memories are made by locals and visitors alike.

For over a century, The Fairmont Hotel San Francisco has enchanted guests with its joyful holiday festivities and seasonal ambiance in The City by the Bay. One of the hotel’s most spectacular annual traditions is its stunning gingerbread house. At the end of November each year, the hotel lobby transforms into one of the world’s most beloved holiday destinations, where cherished memories are made by locals and visitors alike.

The highlight of this awe-inspiring exhibit is the glowing, two-story Victorian-style gingerbread house, adorned in hundreds of pounds of See’s Candies iconic sweets, located in the hotel’s grand lobby. The Fairmont Hotel San Francisco’s talented culinary team, led by Executive Chef Eric Marting, meticulously planned the construction of this year’s enormous gingerbread house, which is even larger than in past years.

The 2023 gingerbread house stands at more than 22 feet high and 23 feet wide, and includes thousands of homemade gingerbread bricks, and more than a ton of royal icing and candy decorations. The hotel partnered with See’s Candies to decorate its gingerbread house and holiday displays this year. Hundreds of pounds of See’s Candies—including their iconic lollypops, sour candies, and chocolate confections—were artfully placed on the breathtaking gingerbread house, creating a true work of art.

To get a taste, guests, San Francisco residents, and visitors to the city are encouraged to stop by the See’s Candies pop-up location in The Fairmont Hotel San Francisco’s lobby to purchase an array of sweet offerings. The pop-up shop will be open during peak periods throughout the holiday season. Guests and visitors are invited to come experience this year’s gingerbread display between Nov. 25 and New Year’s Day.

A Beaux-Arts masterpiece designed by Julia Morgan, The Fairmont Hotel San Francisco was inducted into Historic Hotels of America in 2001.

The Otesaga Hotel (1909) Cooperstown, N.Y.

Located within the Cooperstown Historic District in Cooperstown, The Otesaga Hotel is a historic resort hotel that exudes elegance and authenticity. The holiday gingerbread display has been a tradition at The Otesaga Hotel since the early 1990s, and the 2023 gingerbread display is set up in the main lobby, where guests can enjoy it immediately upon arrival.

This year, the gingerbread village display features an Adirondack Lake & Lodge theme, celebrating the rustic aesthetic that the Adirondack Mountains are famous for. The display required a team of four to mix, roll, cut, and bake over the course of three days. It took an additional 32 hours, spread out over 2 days, to assemble and decorate the village.

The gingerbread village display is 4.5 feet wide and 7 feet long, and weighs approximately 100 pounds, including 40 pounds of gingerbread dough, 44 pounds of powdered sugar, 1 gallon of egg whites, and over 800 candies, cookies, and cereal pieces for decoration. During the holidays, the resort offers gingerbread house decorating, as well as cookie decorating activities for guests both young, and young at heart.

The gingerbread display brings the history of the iconic resort to life, offering guests another way to experience the holiday season with a visit to Cooperstown, home of the National Baseball Hall of Fame and Museum, and affectionately known as “America’s Most Perfect Village.”

JW Marriott Savannah Plant Riverside District (1912) Savannah, Ga.

Located in a fabulously repurposed power plant dating back to 1912, the historic and elegant JW Marriott Savannah Plant Riverside District is a contemporary riverside retreat. In December, visitors can get into the holiday spirit while taking in the hotel’s magnificent gingerbread display, as well as its Savannah Christmas Market, holiday dinners, and cookie decorating.

Located in a fabulously repurposed power plant dating back to 1912, the historic and elegant JW Marriott Savannah Plant Riverside District is a contemporary riverside retreat. In December, visitors can get into the holiday spirit while taking in the hotel’s magnificent gingerbread display, as well as its Savannah Christmas Market, holiday dinners, and cookie decorating.

The hotel’s magnificent gingerbread display is an annual tradition, with a fresh design selected each year. This year’s display is a stunning replica of the historic hotel’s front entrance, capturing the essence of its iconic façade, complete with intricate details, such as windows and brickwork. The gingerbread replica is meticulously created to scale, highlighting the grandeur of the historic Savannah Power Plant.

This delicious display not only mirrors the exterior—it also showcases the reimagined interior, adorned with exquisite crystals and geodes that grace the Generator Hall lobby. Crafting this culinary marvel required the collaborative efforts of a talented team of ten pastry chefs, who began work in October.

The display, standing over 13 feet long and 10 feet tall, is composed of over 10,000 gingerbread bricks, 300 pounds of candy, 650 pounds of gingerbread, and 200 pounds of icing. Positioned in the front lobby Turbine, the seasonal masterpiece offers a captivating photo opportunity for guests visiting the hotel’s Savannah Christmas Market.

The celebration continues throughout the holiday season with a cookie decorating event in Turbine—providing a direct and delicious experience for guests of all ages.

Omni Grove Park Inn (1913) Asheville, N.C.

Omni Grove Park Inn hosted the 31st Annual National Gingerbread House Competition in November, an annual tradition it has organized since 1992. The gingerbread competition began with a small group of gingerbread houses built by Asheville community members as another way to celebrate the holiday season, with no plans to continue the following year.

There was no possible way to know that over 30 years later, the Omni Grove Park Inn National Gingerbread House Competition would be one of the nation’s most celebrated and competitive holiday events. The Omni Grove Park Inn displays every entry throughout the resort beginning on Nov. 27 and continuing through Jan. 2.

Guests not staying at the resort are invited to view the display after 6 p.m. on Sundays, or any time Monday through Thursday, based on parking availability and excluding holidays and select dates.

Since it began, the Inn’s gingerbread display of competition entries has become a true family holiday tradition. This year’s winners were a niece and aunt baking duo from North Carolina, and it was their third year competing, and first time winning, the competition. They submitted a display called “Christmas at the Tongkonan,” a confectionary replica of a traditional Indonesian house.

John Cook, the resort’s Executive Pastry Chef and a Gingerbread Judge, said, “From the moment you drive on property, you can feel the energy of every competitor. It has gone from a national competition to a giant family reunion. There are so many competitors who have come back year after year, not only to rise in the ranks and possibly win, but to see their friends grow along the way, too. The ambiance of the hotel and its history, along with the competition, really set the stage for our competitors to come in and put their best foot forward.”

Listed in the National Register of Historic Places, the Omni Grove Park Inn was inducted into Historic Hotels of America in 2000.

Hotel Du Pont (1913) Wilmington, Del.

This holiday season, Hotel Du Pont—a Charter Member of Historic Hotels of America since 1989—celebrates the magic of winter with a remarkable and meticulously-designed gingerbread village display, reflecting the architecture of 20th-century Wilmington. Led by Executive Pastry Chef Leah Ferrera, this confectionery masterpiece took seven days to mix, bake, assemble, and decorate.

The display, now affectionately known as the Gingerbread Park, spans over 12 feet and features over 40 individually decorated houses, showcasing over 30 pounds of gingerbread dough and 20 pounds of royal icing. Located in a dedicated space just off the hotel’s main lobby, the Gingerbread Park is more than just a visual treat; it is an immersive holiday experience. Guests are invited to delight in the historic Hotel Du Pont’s holiday festivities, including gingerbread cookie workshops every Saturday in December.

Hotel Du Pont’s gingerbread tradition is a cherished activity that has delighted guests for decades. This display, woven into the hotel’s festive fabric, offers both guests and staff a chance to share in the season of joy and light.

Chatham Bars Inn (1914) Chatham, Mass.

The town of Chatham comes to life in the sweetest way through the Chatham Bars Inn’s gingerbread village this December. The seaside resort’s gingerbread display is 16 ft. long by 8 ft. wide and features significant landmark buildings from the town of Chatham, in addition to the historic hotel, including the Train Museum, Chatham Bars Inn, The Chatham Squire, Chatham Lighthouse and Coast Guard Station, Orpheum Theater, as well as the church and fish pier.

Molded waves lap sugary sand at the edges of the gingerbread village, and fondant evergreen trees dot the candy landscape. There are built-to-scale cars and boats, as well as a working train on a track, throughout the gingerbread display. The gingerbread village is displayed in the hotel lobby, directly across from the front desk. The gingerbread team spends an estimated 250 hours working on the display each year to mix, bake, and set up the display.

During the holiday season, the Inn hosts several Gingerbread Workshops, where the award-winning pastry team bakes and assembles gingerbread houses and guests have the fun part, decorating them with an array of edible frosting and candy, making the experience fun, easy, and delicious. Guests also enjoy complimentary cookies, cocoa, and coffee while creating their masterpieces. Over 20 gallons of royal icing, 1,000 gingerbread shingles, and 10 pounds of fondant — all created with over 70 pounds of powdered sugar and more than 100 eggs — turn a tabletop into an oceanside winter wonderland.

The gingerbread display at Chatham Bars Inn is a beloved, time-honored tradition cherished by all guests of the Inn and visitors of all ages.

La Fonda on the Plaza (1922) Santa Fe, N.M.

Every year in mid-December, the decorating masters at La Fonda on the Plaza roll out a majestic 2.5 feet by 2.5 feet gingerbread replica of the adobe hotel to display in the lobby. For decades, the masterpiece was spearheaded by the hotel’s former purchasing manager, Gil Mesa. La Fonda continues the tradition of honoring Mesa’s legacy during the holiday season.

Now, Chef Lane Warner, and Chef de Cuisine Rafael Zamora continue Mesa’s legacy with a decked-out stucco structure, sporting traditional décor and details inspired by the hotel’s past. With artistic nods to famous railway hotelier Fred Harvey, pioneering designer and architect Mary Elizabeth Jane Colter, architect John Gaw Meem, and the famous Harvey Girls, the sweet scene harkens back to the early era of La Fonda hospitality.

After assembly, the culinary crew spends hours crafting powdered-sugar-tipped pine trees, glazed sugar-painted windows (a tribute to artist Ernesto Martinez, best known for his whimsical paintings on the windowpanes in La Plazuela), and finishing with stiff royal icing, depicting the frosty high-desert snow of New Mexico.

Finally, the display is complete with traditional farolitos illuminated with LED lights to celebrate the season. La Fonda debuts the gingerbread hotel every year in mid-December for both guests and locals to enjoy. La Fonda on the Plaza was inducted into Historic Hotels of America in 1991.

Hilton Chicago (1927) Chicago

The stylish and stunning Hilton Chicago unveiled its gingerbread display depicting Chicago’s urban winterscapes on Nov. 15, alongside the hotel’s decorated Great Hall. The gingerbread display was lovingly crafted by Executive Chef Mario Garcia and Pastry Chef Wing Au, and the holiday display pays homage to the city of Chicago, incorporating a gingerbread replica of Hilton Chicago, Soldier Field and more.

Standing over 6 feet tall, it took three pastry chefs nearly 300 hours to create, and was built from 380 pounds of flour, 16 pounds of ginger, 16 pounds of cinnamon, and 16,000 gingerbread bricks. The sweet historic hotel is placed near the lobby’s 24-foot holiday tree, which is decorated annually with thousands of metallic ornaments, and together both are the centerpieces of the lobby’s floor-to-ceiling décor, with 2,000 inches of decorated garland, a 30-inch-tall poinsettia “kissing ball,” and 60-foot wreaths.

The Hilton Chicago welcomes guests and locals to visit the lobby area and make the gingerbread hotel and Chicago skyline the ultimate backdrop for seasonal holiday photos and Instagram-worthy moments. A member of Historic Hotels of America since 2015, Hilton Chicago is the third-largest hotel in Chicago, and has hosted every United States president since it opened its doors in 1927.

The Settlers Inn at Bingham Park (1927) Hawley, Pa.

The holiday gingerbread display tradition at The Settlers Inn at Bingham Park began over 30 years ago, and today, the edible display is part of a beloved annual event, Candlelight Christmas. Founder Jeanne Genzlinger and her friend, Marcia Dunsmore, envisioned a celebration that blended time-honored holiday traditions, beloved childhood memories, and treasured Christmas fantasies.

Originally known as Victorian Christmas, the event was re-named Candlelight Christmas to reflect a universal symbol of goodwill, light and hope. The event features Sleigh Ride Punch (Syllabub and mulled wine), horse and carriage rides, and—of course—the gingerbread house display.

This year’s display required three days to bake and assemble. The finished product is an exact replica of the historic Arts-and-Crafts-style Tudor lodge. No detail is overlooked in the recreation, from the Inn’s iconic dormer windows to the vintage Victorian sleigh on the front porch. A chocolate roof and windows made from poured melted sugar add to its rich appearance.

Victorian-era figurines posed throughout the display, and confectionary sugar snow help to set the festive scene. It is prominently displayed in the lobby across from the front desk for the duration of the holiday season, and guests are invited to take photos with it.

This year in December, the Inn offers a Christmas Tea. Guests visiting on Thursday afternoons this month can enjoy all the holiday décor, including the gingerbread display, as they savor freshly brewed teas, finger sandwiches and decadent desserts. A charming destination during any season, The Settlers Inn at Bingham Park sits on six acres of land, surrounded by artfully designed gardens, and bordered by the Lackawaxen River and woodlands that contain a portion of the old Delaware & Hudson Canal. This historic inn was inducted into Historic Hotels of America in 2010.

Skytop Lodge (1928) Skytop, Pa.

The magnificent gingerbread hotel display at Skytop Lodge has been a holiday tradition since 2013. Each year, it is presented as a replica of the Main Lodge, featuring the porte-cochere.

In its tenth year now, the gingerbread display is located in the main lobby of the Main Lodge, and measures about 20 feet wide, and is about 12 feet deep, reaching a height of about 12 feet from its base. Production began in August, when the staff started baking the gingerbread bricks.

The sweet-smelling shell of the house went up on Nov. 1 around a wood frame, and the staff decorated the gingerbread display the week of Thanksgiving. Guests who were present that week were invited to help add candy to the design.

The 2023 Skytop Lodge gingerbread display ingredients added up to 450 pounds of flour, 700 eggs, 13 pounds of gingerbread spices, 150 pounds of honey, 150 pounds of molasses, 12 pounds of baking soda, 80 pounds of shortening, and 10 pounds of candy decorations. The icing used in the Skytop Lodge gingerbread display required 500 pounds of powdered sugar, pushing the display’s total weight to more than 2,300 pounds!

This holiday season, Skytop Lodge guests are invited to join in holiday activities, including gingerbread cookie decorating. The display will be up through Jan. 8 and the public is welcome to stop by to see it. Established in 1928, Skytop Lodge was inducted into Historic Hotels of America in 2000.

Alisal Ranch (1946) Solvang, Calif.

Alisal Ranch partners each year with the Solvang Bakery to create charming gingerbread replicas of the luxury Dude Ranch’s barn, front office, library, boathouse and guest cottage. The gingerbread houses are each about a foot wide, and they are arranged in a display of fluffy “snow,” illuminated with fairy lights, and embellished with sparkling baubles and fir boughs.

The houses are accompanied by charming ranch details, such as miniature hay bales, horses, friendly golden retrievers and barn cats. These ranch-inspired gingerbread houses are on display in the resort’s dining room from the beginning of December.

During the construction, the Solvang Bakery used approximately 100 pounds of gingerbread dough, and 75 pounds of icing to produce the display, which involved the labor of six people, who worked for about three weeks to produce the sweet, miniature dude ranch. In addition to an eye-catching festive display, each guest staying at Alisal Ranch over Christmas Eve and Christmas Day will also be gifted a personalized gingerbread house decorating kit, providing a fun family activity to do on-site, or to take home as a keepsake of holiday memories made at Alisal Ranch.

Rancho Bernardo Inn (1963) San Diego

This year marks Rancho Bernardo Inn’s 14th holiday season decked with a magnificent gingerbread display, and the historic resort is upping its decor game in 2023 with its largest display yet. Complete with a gingerbread village, the display is more immersive for guests than previously, with intricately crafted life-sized gingerbread houses and various other whimsical structures. While it does not portray a real place, the design aims to evoke a festive and enchanting atmosphere.

The inn itself was designed in 1963 in the Mediterranean Revival-style, but the Neoclassical style-inspired gingerbread house is complete with two wings attached to the central structure, gable roofs, and portico—all formed by sweet gingerbread and bright candy décor. To create Rancho Bernardo Inn’s Gingerbread House Experience, a team of bakers, pastry cooks, and engineers came together over 4 days to set up this incredible, edible house of candy.

However, the entire process, from mixing the ingredients to baking and assembling the full display, spans over a month. The Gingerbread House Experience construction required 1,000 pounds of flour, 1,000 pounds of sugar, 128 pounds of molasses, 240 pounds of eggs, and 400 pounds of candy. Guests are invited to walk through and around the display, which is in the main lobby, and take advantage of this fantasy background for photo opportunities.

Additionally, the resort offers mini gingerbread houses for sale in Café Granada, for guests who want to bring home a piece of the experience.

“The tradition of gingerbread fairy-tale houses reportedly started in the United States more than 200 years ago with the German immigrants to Pennsylvania. Today, travelers can view life-size historic hotels, national monuments, historic buildings, and historic main streets made of gingerbread. A large party of people can dine in the more-than-life-sized gingerbread house at the Fairmont San Francisco,” said Lawrence Horwitz, executive vice president, Historic Hotels of America and Historic Hotels Worldwide.

“Congratulations to the hundreds of people that worked to create the 2023 Top 25 Historic Hotels of America Most Magnificent Gingerbread displays. This holiday season, “run, run as fast as you can” and catch the most magnificent gingerbread houses and displays at many Historic Hotels of America.”

For more news of interest to the specialty food industry, subscribe to Gourmet News.

Prime Shrimp to Give Away Free Products to New Orleans Winner

Prime Shrimp, a New Orleans-based maker of seasoned and sauced frozen shrimp products, is ringing in the New Year with its Free Shrimp for a Year 2024 giveaway. One lucky winner from the greater New Orleans area will receive a 1-year supply of free shrimp equal to 4 pounds per month. Consumers can enter via Instagram or Tik Tok on or before Dec. 30. The brand has partnered with New Orleans-based content creator Alex Robinson to spread the news via Tik Tok and Instagram.

Prime Shrimp, a New Orleans-based maker of seasoned and sauced frozen shrimp products, is ringing in the New Year with its Free Shrimp for a Year 2024 giveaway. One lucky winner from the greater New Orleans area will receive a 1-year supply of free shrimp equal to 4 pounds per month. Consumers can enter via Instagram or Tik Tok on or before Dec. 30. The brand has partnered with New Orleans-based content creator Alex Robinson to spread the news via Tik Tok and Instagram.

“Shrimp is a staple in the Gulf South, and we want to create exciting new options that offer value and convenience, so shrimp is an easy choice to cook even more often,” said Matt Rosenthal, commercial manager at Prime Shrimp. “With this giveaway, we hope to share what we’ve created with the greater New Orleans community, and to create excitement about an innovative new shrimp product.”

Prime Shrimp, a company steeped in nearly 80 years of seafood industry knowledge, is working to revolutionize the seafood category with a fresh take on shrimp offerings. The brand offers sustainably sourced seasoned and sauced shrimp in vacuum-packed boil-in-bag technology unlike anything else seen in common seafood aisles today. With this unique value-added product, Prime Shrimp combines the best of quality and convenience to make shrimp a quick protein option for home chefs of any skill level.

The winner of the Free Shrimp for a Year 2024 giveaway will receive eight packages per month of any flavor of Prime Shrimp’s frozen boil-in-bag seasoned and sauced shrimp products delivered directly to their home for a total of 12 months, beginning January.

All shoppers are invited to enter via Instagram or Tik Tok. To enter the giveaway, shoppers must follow Prime Shrimp on Instagram and/or Tik Tok and comment on the giveaway post tagging two friends on or before December 30.

The potential winner will be chosen at random and notified by social media direct message on or around Jan. 3. The notification will be sent to the profile used to enter the giveaway via Instagram or Tik Tok comments. After the potential winner responds to the email and their eligibility is confirmed, Prime Shrimp will provide further instructions on obtaining their 12-month supply of shrimp. Shrimp may be dispatched monthly or all at once, according to shopper preference.

For simple steps on how to enter, visit https://www.primeshrimp.com/blogs/news/free-shrimp-for-a-year-sweepstakes-2024

Regardless of the giveaway, all shoppers can save on shrimp throughout the holiday season with weekly sale promotions from Prime Shrimp now through the new year. Available in a range of sauced and seasoned varieties, Prime Shrimp’s frozen shrimp are carefully peeled, deveined and packed with precision in the United States, delivering unmatched freshness and quality.

Customers can shop all seven flavors plus a variety of merchandise and gift card options with the flexibility and convenience of Prime Shrimp’s website. Every shopper’s first order ships free. For more information about the giveaway and holiday promotions, visit Prime Shrimp’s website.

Prime Shrimp makes restaurant-quality seafood accessible at home. Headquartered in New Orleans, Prime Shrimp was created by the original shrimp experts. We’ve combined three generations in the shrimp processing game with easy cooking methods, sustainable sourcing, and world-class flavors, so food lovers everywhere can add delicious, clean seafood to any meal. In an era when increasingly fast-paced lifestyles mean less time for home-cooked meals, Prime Shrimp upscales convenience food, so even busy and beginner home chefs can eat gourmet any day of the week.

For more news of interest to the seafood industry, subscribe to Gourmet News.

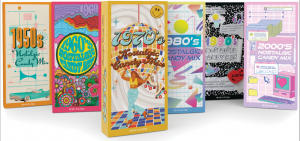

Nassau Candy Updates Decades Box Nostalgic Candy Gift Sets

Nassau Candy, leading manufacturer of specialty and private label confections, is unveiling a new look for its popular Decades Box Nostalgic Candy Gift Sets. The re-design serves up a more interactive experience, making the Decades Boxes more giftable, while featuring a new assortment of nostalgic goodies.

Nassau Candy, leading manufacturer of specialty and private label confections, is unveiling a new look for its popular Decades Box Nostalgic Candy Gift Sets. The re-design serves up a more interactive experience, making the Decades Boxes more giftable, while featuring a new assortment of nostalgic goodies.

Each new Decades Box has the signature look and feel of the decade while still creating a cohesive presentation when merchandised together. But what makes the re-design extra fun and interactive are hidden facts about that particular decade incorporated into the design. This is intended to spark memories, conversation, and add to the nostalgic experience.

Not only does the new art make the Decades Boxes more appealing gifts, it also makes merchandising simple. The new package art is vertical on one side and horizontal on the other, allowing for multiple merchandising options.

Also new for the re-launch is the addition of a 2000s box. It joins the current line, which features 50’s, 60’s, 70’s, 80’s, and 90’s boxes.

“Nostalgic candies are the most sought-after confectionery items,” said Dana Rodio, director of brand strategy for Nassau Candy. “Our re-designed Decades Boxes offer up their longtime candy favorites all in one place, while transporting them back in time with nostalgic imagery and fun facts. That’s why the entire Decades Box line has long been a favorite gift for milestone birthdays and as party centerpieces.”

The fully re-designed Decades Boxes are available and shipping. To see the entire line and other Nassau Candy gifting options, visit, www.nassaucandy.com.

For more news of interest to the confections industry, subscribe to Gourmet News.